Does Your Business Have to Be Regular and Continuous to Take Deductions Agains the Income?

You may already know that if you lot're under total retirement age and file for Social Security benefits, there's a limit to the amount of income you tin brand before your benefit is reduced — or shut off completely.

Only there's i large question that keeps coming up when I talk to people well-nigh this topic: What counts as income?

Today, let'southward find the respond. I'll cover what the Social Security Assistants considers income too every bit what doesn't count on your earnings test.

Before we become there, let's go over a quick overview of how the earnings test for determining whether or not you lot're hitting the earnings or income limit works.

What You Need to Know About the Social Security Earnings Test and Income Limit

The beginning matter to know is that, right at present, the earnings limit only applies before your full retirement historic period. In one case you lot accomplish your full retirement age, you tin earn a bazillion dollars and go along to receive your full Social Security benefit.

(Changing this is one mode that nosotros could gear up a breaking Social Security arrangement.)[1]

Because full retirement age differs based on your year of birth, we demand to take a quick look at the table and then you lot'll know exactly when your full retirement historic period is.

- If you were born between 1943 and 1954, your full retirement age is 66.

- For 1955, the age is 66 and two months.

- For 1956, it's 66 and 4 months.

- For 1957 the age is 66 and 6 months.

- For 1958, full retirement age is 66 and 8 months.

- For 1959, it's 66 and x months.

- For those born in 1960 or afterwards, the full retirement historic period is set at age 67.

Evidently, the current full retirement age if you were built-in subsequently 1960 is subject area to change with the proposals floating around to fix Social Security — merely this is where we are right at present.

How the Earnings or Income Limit Relates to Your Full Retirement Age

If you lot make more than $19,560, the Social Security Assistants will withhold $1 in benefits for every $2 in income that exceeds that amount.

The one exception is during the agenda yr you accomplish full retirement age. During that period, the earnings limit nearly triples and the withholding amount is not as steep.

For every $3 y'all earn over the income limit, Social Security volition withhold $1 in benefits. At your full retirement age, there is no income limit.

The $19,560 amount is the number for 2022, but the dollar corporeality of the income limit will increment on an annual footing going forward. You demand to keep upwardly with the year-to-year changes to stay informed.

(Want to brand this very piece of cake to do? Just subscribe to my YouTube channel, because nosotros practice an update for these numbers as soon equally we see them!)

Now that you have a basic understanding of the income limit, nosotros need to await at what actually counts every bit income toward that limit.

Thankfully, the Social Security administration makes information technology easy to empathize for most types of income that you might ordinarily receive. First, let's look at the income that does not count.

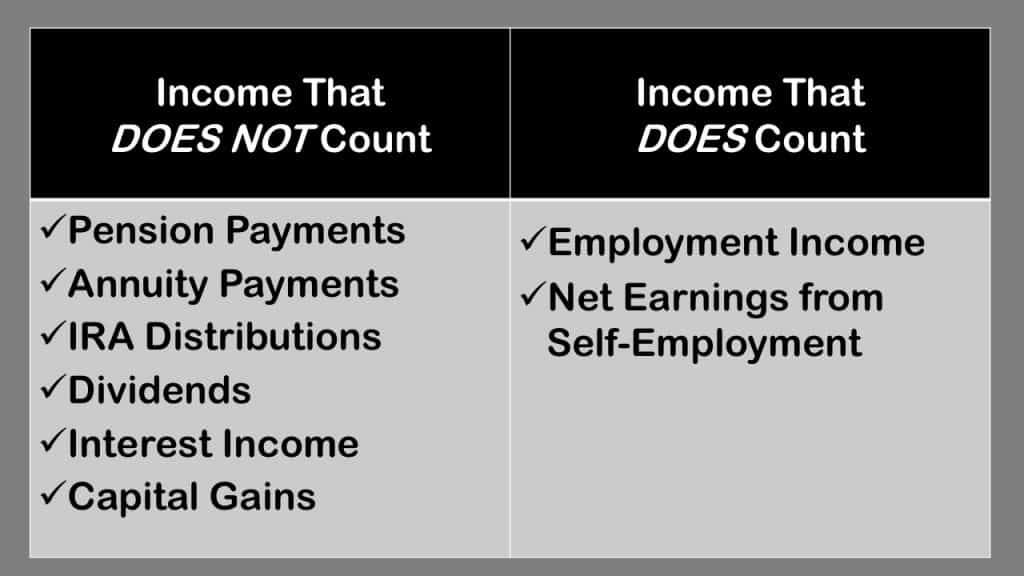

Income that does not count toward the earnings limit includes:

- Alimony payments

- Most annuity payments

- IRA and retirement account distributions

- Dividends

- Interest income

- Capital gains

As the law is currently written, you can receive an unlimited amount of income from the sources above and receive your full Social Security benefit.

The income that does count in the earnings limit is employment income. That means gross employment wages if you're an employee and/or your net earnings from self-employment.

Some Income Sources Are Harder to Classify Than Others

This prissy, concise list volition have intendance of 95% of all the types of income that exists. But there are numerous other types of income that can cause confusion.

You might have back pay, bonuses, holiday pay, deferred comp, fiduciary fees, renewal commissions — the listing goes on. Unfortunately, nosotros can't go through each of these in item here because even the Social security administration'southward page lists 88 unlike types of income!

To confuse it fifty-fifty further, there are some types of income that'south non counted for employees, just it is counted for those who are self-employed.

You can take a look at that page to learn more almost how these different types of income are treated. Some of this income is counted, some of this income is not counted — simply before you get too stressed about this, call back that 95% of income sources are hands classified with our elementary list above.

If you are under full retirement age and receive income from a source that is non i of the common ones nosotros discussed above, y'all'll probable receive a letter of the alphabet from the SSA alleging an overpayment.

If you lot do, DON'T IMMEDIATELY ASSUME Y'all HAVE TO PAY THE AMOUNT Dorsum.

You practice demand to communicate with the Social Security Assistants about this discover, or they'll turn you do good off — but just considering you receive a letter saying that the earnings test should've practical doesn't mean they are right.

I've seen multiple cases in which all a client had to do was write a letter of caption because the error was on the SSA's stop.

Just exist enlightened that when it comes to the earnings test, the Social Security Administration seems to utilize the same playbook as the IRS does when they have a question. Instead of sending you lot a letter to get clarification, they simply presume they are right and tell send you a alphabetic character saying how much you owe in additional taxes.

For example, if a customer sells a stock and doesn't include the cost basis, the IRS just assumes the unabridged amount of the proceeds should be a capital letter gain. Yous have to go dorsum to them and tell them how much of the proceeds were the cost ground and how much represented an actual gain.

The Social Security Administration volition often practise something similar when it comes to the earnings exam and payments or income you received. They'll send you an overpayment letter of the alphabet that says something along the lines of,

"Because you received this payment you should not have received your do good. Starting on X date, we are going to stop paying your monthly benefit until the overpayment is recovered."

Then the burden is on you to explicate why the payment doesn't count equally income for the earnings examination.

(As a side note to this…I recommend watching my video on How To Fix Social Security Overpayment Notices. I explicate the procedure to file appeals and how to explicate your position using their rules. If yous get one of these letters, practise some research to protect yourself!)

It's Not But Income That Matters – It'south Timing, Too

Additionally, the Social Security Administration will often desire clarification on the timing of your earnings. In some cases, you may have earned money while you lot were however working, just didn't receive it until later you stopped working and filed for Social Security.

Does that income still count? The answer is, it depends. The rules are slightly different for employees and for cocky-employed workers.

For previous employees, the Assistants's commodity, How Work Affects Your Benefits, says if you piece of work for wages, income counts when its earned, not when its paid.

Then information technology goes on to say if you're self-employed, income counts when you lot receive information technology, not when you earn it. But there's a time qualifier on the end of that judgement; it goes on to say that this is true "unless [the earings are] paid in a year later yous go entitled to Social Security and earned earlier you became entitled."

Effectively, this means that if the payment occurs in the taxable yr later on you file for benefits, it will not count against the earnings limit as long every bit the work was performed before you filed for benefits.

Only even inside these rules there are some types of payments that fall in the cracks and don't line upwards perfectly with these rules. Again, I want to strongly emphasize that if you receive a observe from the SSA alleging that you earned more than the allowable amount, dive into the rules to brand sure they are correct.

I hope you…they are not always right.

Questions?

If you still have questions, you could leave a annotate below, but what may be an even greater aid is to join my FREE Facebook members grouping. It's very agile and has some really smart people who honey to answer any questions you lot may have about Social Security. From time to fourth dimension I'll even drop in to add my thoughts, too.

One terminal thing, be certain to get your FREE copy of my Social Security Cheat Canvas. This is where I took the nearly of import rules and things to know from the 100,000 page Social Security website and condensed information technology down to just ONE PAGE! Go your Gratis copy hither.

If you're wanting to go into the nitty-gritty of the research, hither are a few resources that may help.

My video: How To Set up Social Security Overpayment Notices

https://www.youtube.com/picket?v=MkYXVwMmx0w

Social Security Handbook Chapter on Wages – https://www.ssa.gov/OP_Home/handbook/handbook.xiii/handbook-toc13.html

SSA publication "How Work Affects Your Benefits"

https://www.ssa.gov/pubs/EN-05-10069.pdf

SSA POMS RS 02505.240 Summary of How Major Types of Remuneration Are Treated

https://secure.ssa.gov/apps10/poms.nsf/lnx/0302505240

SSA POMS RS 02505.005 How to Count Wages Under the Earnings Test (ET)https://secure.ssa.gov/apps10/poms.nsf/lnx/0302505005

SSA POMS RS 01402.000 Wage Exclusions

https://secure.ssa.gov/apps10/poms.nsf/lnx/0301402000

SSA Publication "Special Payments After Retirement"

https://www.ssa.gov/pubs/EN-05-10063.pdf

SSA POMS RS 02510.016 Handling of Special Payments (SP)

https://secure.ssa.gov/apps10/poms.nsf/lnx/0302510016

fostergavempurneth.blogspot.com

Source: https://www.socialsecurityintelligence.com/social-security-income-limit-what-counts-as-income/

0 Response to "Does Your Business Have to Be Regular and Continuous to Take Deductions Agains the Income?"

Post a Comment